Solar Incentives

Our Sunshine State offers several solar incentives, making it easier to become energy independent.Property Tax Exemption

Normally, anytime you add value to your home the State wants a piece of it, by increasing your property tax bill. Not so, with Solar.

Basically, you are increasing the value of your home, but not increasing your property tax bill.

FL State Sales Tax Credit

Florida’s Solar and CHP Sales Tax Exemption saves you 6% state sales tax on your Residential Solar System, a tax that you would otherwise pay.

Basically, your are keeping 6% in your pocket, now that's a nice savings.

Net Energy Metering (NEM)

Your local utility company will purchase your surplus energy produced from your solar system, in the form of credits, and apply to your future electric bills.

Basically you are banking your excess solar energy, until a time that you may need it.

Local Solar Incentives

There may be additional State, Local and Utility incentives to Go Solar, depending on your city.

To View Local Energy Incentives

Click Here

Federal Tax Credit

The Federal Tax Credit (ITC) is slowly fading into the sunset. Don't lose out!

If you are considering purchasing a Commercial or Residential Solar System, then don't forget to factor in the Federal Solar Tax Credit.

The tax credit is for the entire cost of your solar system, which includes solar equipment, freight, installation, permits, consulting fees, and battery storage.

Credit is only applicable if you purchase your Solar System outright, either with a cash purchase or solar loan.

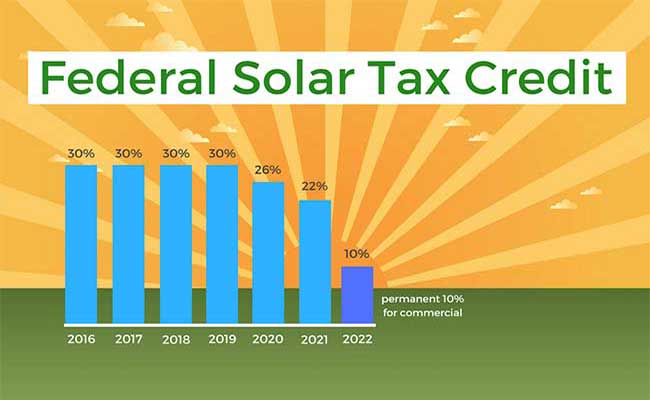

While the Investment Tax Credit (ITC) is a great incentive, time is running out. The Federal Solar Tax Credit gives you a dollar-for-dollar reduction against your federal income tax, which is a great incentive to Go Solar. However, the Investment Tax Credit (ITC) started out as a 30% credit in 2016 and continued through 2019, gradually stepping-down to 26% in 2020, and finally phases out for residential permanently in 2021 with a final 22% credit.

NOTE: Commercial Solar Tax Credit continues in 2022 with a permanent 10% credit.

You can claim the credit in the same year you complete the installation. Make sure you keep all receipts, the more you spend on your solar installation the larger your tax credit.

A quick note. This is not a refund, it is a credit that reduces any federal taxes owed. You can’t take a credit larger than the amount of taxes you owe, because the ITC is a “non-refundable” tax credit. You can, however, claim the credit over more than one year, and carry any leftover amount forward to the next year.

Disclaimer:** As in all tax matters, the taxpayer is advised to consult their tax professional. Sun Coast Roofing & Solar assumes no liability regarding the homeowner’s ability to obtain any tax credit/s.